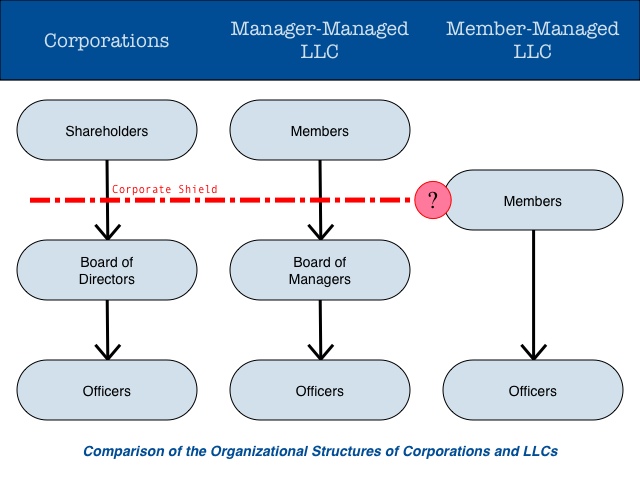

In corporations and manager-managed LLCs, the shareholders/members own the company and elect the board. In member-managed LLCs, there is no board, and the members directly run the business.

When you register a Texas LLC with the Secretary of State, Article 3 on the Certificate of Formation asks whether it will be governed by either A. managers or B. members. In almost every instance you will want to check box A for managers because a manager-managed LLC better protects the members if and when the LLC is sued.

Forms to Register Businesses and Nonprofits in Texas

Owners Invest Money and Elect the Board

In both corporations and manager-managed LLCs, the owners invest money, often called equity, in the company and elect the board. The owners have no ability to directly run the company, though they are required to vote on major changes, such as shutting down, selling most or all the company’s assets or merging with another company. The owners often meet once a year unless there is an exceptional circumstance and an emergency meeting is called. In a member-managed LLC, the owners directly run the company, and there is no board.

The owners of a corporation are called shareholders, and the owners of a LLC are called members.

The Board and the Officers Run the Company

The board sets broad policies for the company and elects the officers such as the president or CEO. Boards meet regularly and direct the officers on how to run the business. They are generally involved in launching new products, expanding into new markets and deciding broad market strategy. The officers, on the other hand, run the day-to-day operations of the business: hiring employees, paying bills, answering the phone, etc. Both often get paid, and both may be liable for the actions of the company.

A corporation has a board of directors, and a manager-managed LLC has a board of managers. Corporations and both kinds of LLC have officers.

The Corporate Shield Protects Shareholders from Lawsuits and Other Liabilities

The most important legal protection of a corporation or a LLC is the corporate shield. The shield protects the owners from the liabilities of the company. If an employee is hurt or a customer is injured, she may sue the company, the officers and even the board, but she cannot sue the owners. Owners are only liable for the amount of their investment, no more. They can only lose the money they put in, not their house/retirement savings/other assets. The shield is invaluable in helping businesses raise money because without it the risk from lawsuits would be too high and no one would invest.

In small companies and startups, it is very common for the owners to also be on the board and/or be officers of the company. In this instance, they may be liable in a lawsuit due to their active role in operating the business.

Member-Managed LLCs Blur the Line Between Owners and Board Members/Officers

The nightmare scenario for a member-managed LLC is silent members. In a corporation or manager-managed LLC, they would simply be shareholders/members but would not be on the board or be officers. In a member-managed LLC, however, there is no way to distinguish their silent role in the company. If there are lawsuits or other liabilities, the LLC will have to prove that they are not responsible because whether the corporate shield protects them is unclear. Member-managed LLCs provide no real benefits over manager-managed and carry the inability to easily protect silent investors.

If you are starting a business, it makes the most sense to choose a manager-managed LLC or a corporation. Then, if an investor comes along, you are ready on day 1 to take her money and grow your company.

Learn More About Forming an LLC in Texas